QuickBooks Self-Employed: Track Mileage & Receipts Details

QuickBooks Self-Employed: Track Mileage & Receipts

com.intuit.qbse

Intuit Inc

App Details

| Updated | Size | Installs |

|---|---|---|

| Oct. 17, 2023 | 99417662 | 5 |

| Version | Code | Category |

|---|---|---|

| 7.59.0 | 759000 |

Accounting

Business Requires Google Play Services |

| Developer | Website | |

|---|---|---|

| Intuit Inc | quickbooks.intuit.com | QB_selfemployed@intuit.com |

Description

QuickBooks Self-Employed is the all in one financial management & bookkeeping app for self-employed workers, freelancers, sole-traders, contractors, and sole proprietors.

Prepare for your HMRC tax returns & refunds - Quickbooks Self-Employed finds income tax deductions and keeps your finances organised by categorising your business expenses. Save receipts and attach them to business expenses to help manage finances.

Be prepared for the UK tax season with Quickbooks Self-Employed. Track expenses, receipts and invoices. Estimate taxes at the end of the year for your tax returns, and save receipts for reference in the app. Automatically track your mileage so you can deduct it as a business expense (available for customers in the U.S, U.K, CAN, & AU only). Sole traders, contractors, freelancers and sole proprietors can now maximise tax deductions on the go!

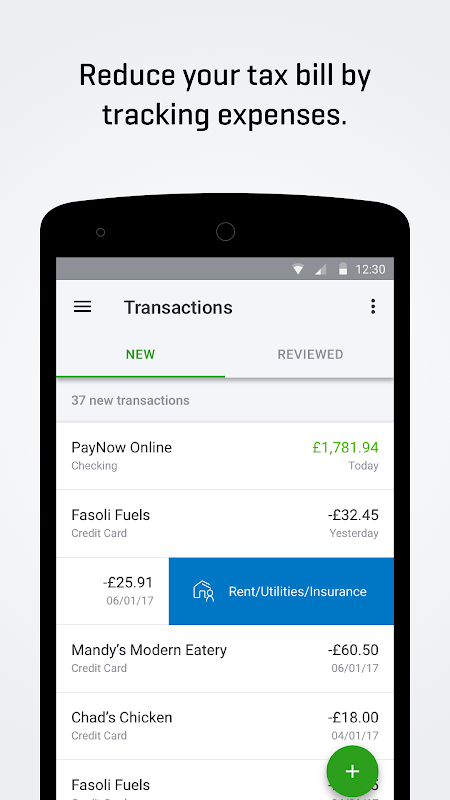

TRACK EXPENSES & MANAGE FINANCES ON THE GO

• With just a swipe, easily log expenses and track business finance expenses separately from personal

• Track expenses to keep up to date

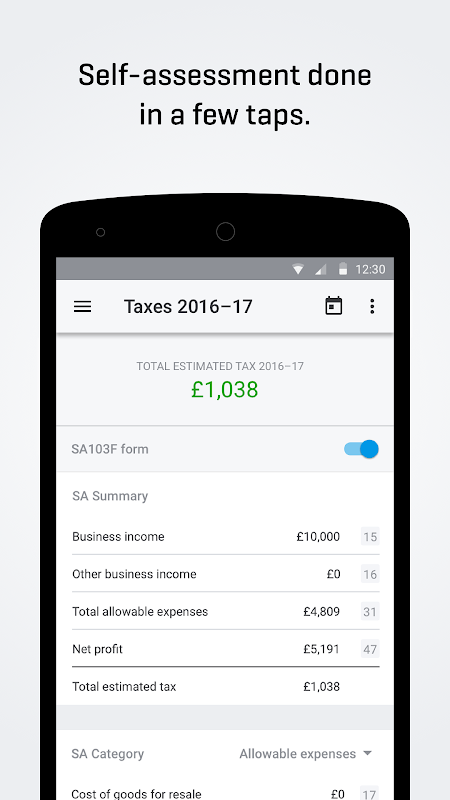

ESTIMATE ANNUAL TAXES

• UK taxes don’t have to be hard when you’re a self-employed freelancer or contractor. QuickBooks Self-Employed makes filing taxes simple.

• QuickBooks Self-Employed tracks your expenses and receipts in order to maximise your tax deductions & returns and prepare you for UK tax time.

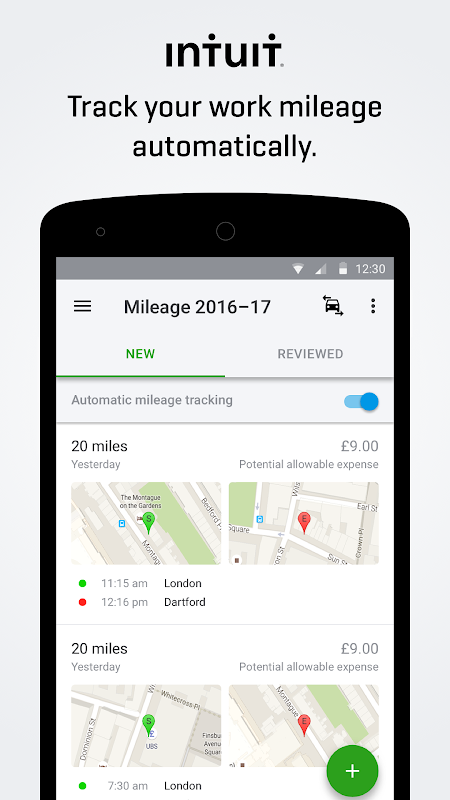

TRACK MILEAGE AUTOMATICALLY

• Every mile you drive for work is worth £0.45 in tax deductions

• Our mileage tracker makes it easy to track work mileage so you can deduct it as a business expense

• Tracker uses your phone’s GPS to log miles quickly & automatically. No more pen and paper to track mileage

SNAP AND STORE RECEIPTS

• Don’t worry about losing receipts, just take a picture

• QuickBooks Self-Employed will track your business receipts and automatically match and categorise your business expenses

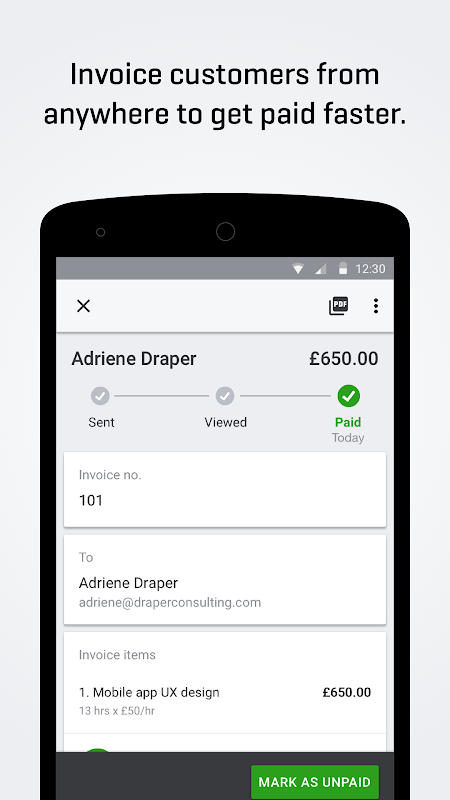

INVOICE CLIENTS ON THE GO

• Easy invoice creation – Make and send invoices anytime, anywhere

• Invoice your clients to get paid, you can add mileage and work hours too

• Add a logo to personalise your invoice

UK taxes don’t have to be hard – Let QuickBooks Self-Employed do the work! Whether you fill out a 1099, Self-Assessment, T2125, B1, BIR60 or more, if you’re a sole trader of any type, save time with QuickBooks Self-Employed so you have more time for what really matters.

And best of all, your financial data is safe and secure because QuickBooks Self-Employed has bank level security. QuickBooks Self-Employed is created by Intuit for sole-traders, contractors & freelancers.

SUBSCRIBE IN THE APP: After your 30-day free trial, subscribe in the app for the monthly auto-renewing subscription.

ALREADY HAVE QUICKBOOKS SELF-EMPLOYED ON THE WEB? The mobile app is Free with your subscription, and data syncs automatically across devices. Just download, sign in, and go! (Available for customers in the U.K and U.S only.)

Price, availability and features may vary by location. Subscriptions will be charged to your credit card through your account. Your subscription will automatically renew unless canceled at least 24 hours before the end of the current period. Manage your subscriptions in Account Settings after purchase.

Continued use of GPS running in the background can dramatically decrease battery life. QuickBooks Self-Employed’ s mileage tracking feature has been designed and optimized to limit GPS usage

To learn how Intuit protects your privacy, please visit: U.K:https://www.quickbooks.co.uk/privacy-policy/

Global: https://quickbooks.intuit.com/global/privacy/