U.S. Bank - Inspired by customers Details

U.S. Bank - Inspired by customers

com.usbank.mobilebanking

Al Rajhi Bank

App Details

| Updated | Size | Installs |

|---|---|---|

| April 6, 2024 | 88011674 | 3 |

| Version | Code | Category |

|---|---|---|

| 3.9.58 | 2005200749 |

Finance

|

| Developer | Website | |

|---|---|---|

| Al Rajhi Bank | usbank.com | 1800usbanks@usbank.com |

Description

SIGN-UP & LOGIN

Easy access is the first step in saving time.

• Streamlined sign-up – We’ve made it easier than ever to enroll!

• Easy options for login – Choose to log in with a username & password or fingerprint.

• Login help – Step-by-step guide to reset your password if you get locked out.

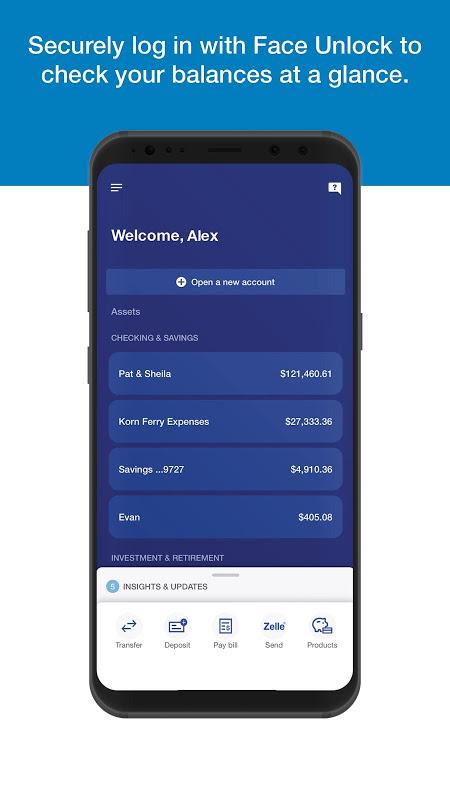

ACCOUNT DASHBOARD

View accounts and manage money all in one place.

• Easily view accounts – Log in once to view checking, savings, credit cards, mortgage, loans, lines of credit, leases, brokerage, trusts, IRAs and CDs.

• Find it fast – Quick-action menus to quickly launch commonly used features.

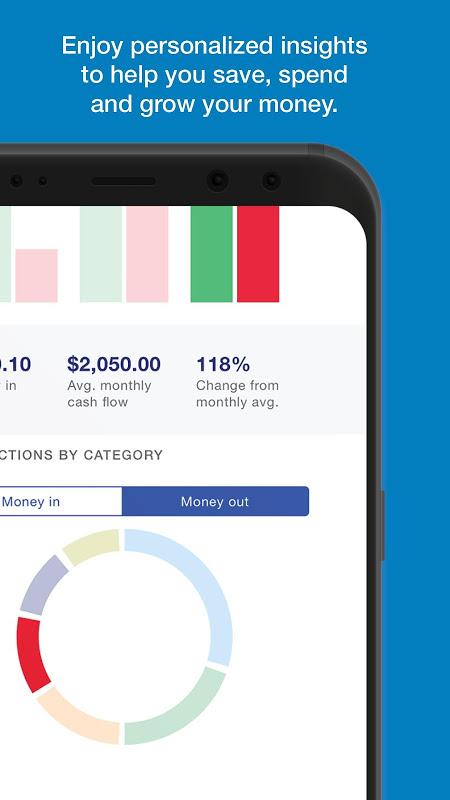

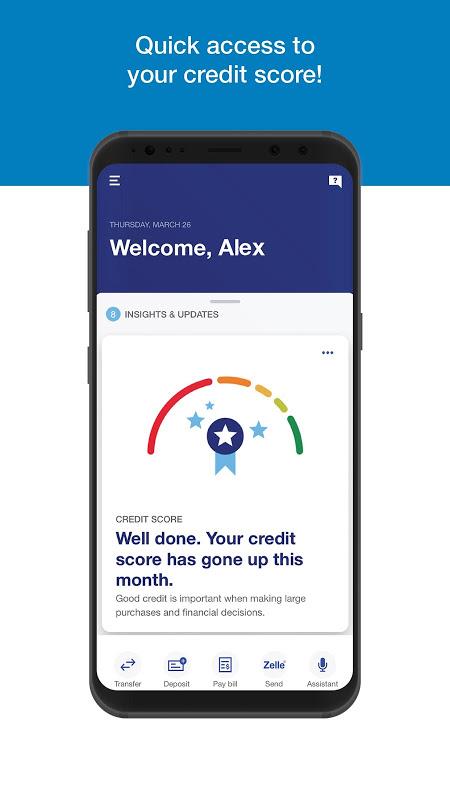

PERSONALIZED INSIGHTS

Personal insights delivered to you.

• Personalized – Based on your spending habits, our app will offer insights on travel, cash flow, spending, saving and investing to help you manage your finances.

• Proactive – Insights highlight opportunities for you to better save, grow and protect your money.

MOVE MONEY

Moving money is easier than ever.

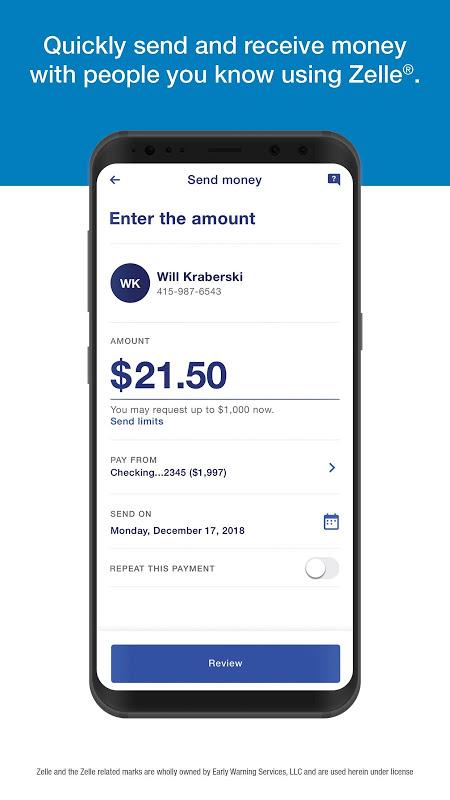

• Zelle® – Send, request and split money quickly and securely with friends and family and pay businesses that accept Zelle payments.1

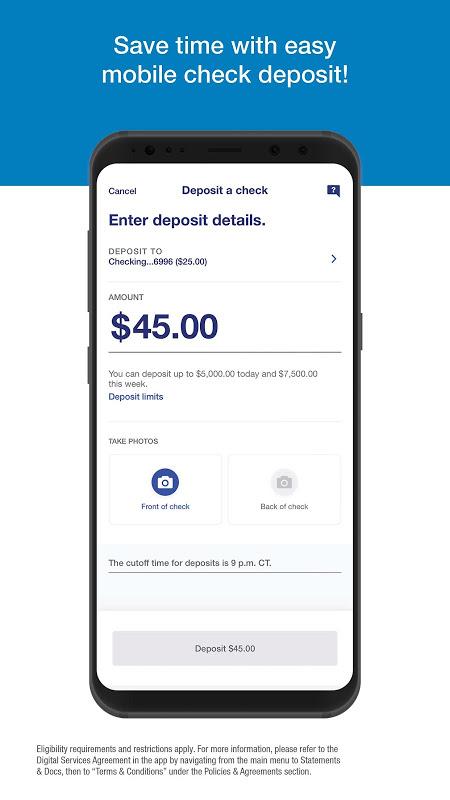

• Mobile check deposit – Updated experience including improved photo-taking capabilities.

• Bill pay – Continue to pay bills and manage billers.

• Transfers – Available for your deposit, investment, broker and IRA accounts.

MANAGE ACCOUNTS AND PREFERENCES

Now it’s easier to customize your settings.

• Control your cards – Set travel notices, change your PIN, lock and unlock debit cards.

• Customize preferences to enable fingerprint login, manage overdraft options or remember username.

• Set account alerts to track balances, deposits, withdrawals, transactions and statements.

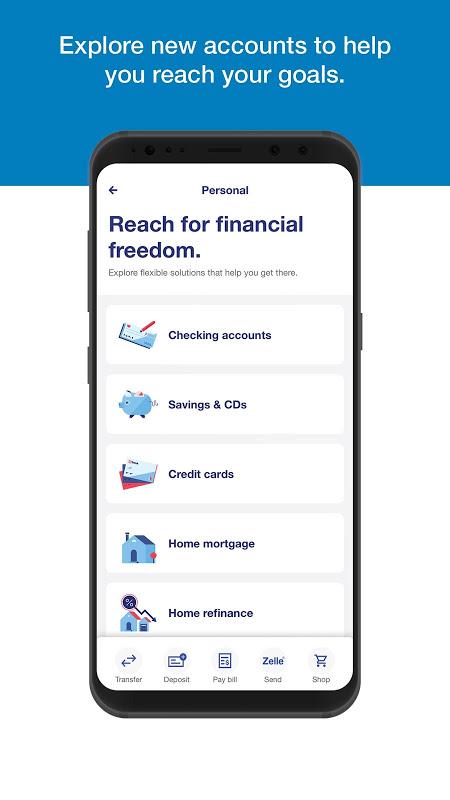

MARKETPLACE

Products and services to help you with your financial needs and goals.

• Personal – Compare and apply for checking and savings accounts, credit cards, mortgages and Simple Loans.

• Small-business lending – Compare and apply for business loans.

• Investment – Find an advisor, open brokerage and Automated Investor accounts and IRAs.

HELP YOURSELF

Here to help with what you need, when you need it!

• Share your screen – When you call for help, you can allow an agent to view your device’s screen to provide better support.

• Guided help – When you pause while making a transaction because you’re unsure what to do next, the guided help feature will automatically appear and recommend next steps (available in Zelle initially).

• Help Center – When searching for a topic, access the Help Center through the main menu.

The Fine Print:

1. Must have a bank account in the U.S. to use Zelle. To send money to a business, a consumer must be enrolled with Zelle through their bank’s mobile app or enrolled in the Zelle app with a deposit account. Businesses are not able to enroll in the Zelle app with a debit card and cannot receive payments from consumers enrolled in the Zelle app using a debit card. Terms and conditions apply. Please refer to the Digital Services Agreement for more information. A fee applies when a Zelle payment is received into a U.S. Bank business account. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

U.S. Bank is committed to protecting your privacy and security. View our privacy pledge at usbank.com/privacy. The U.S. Bank Online Risk-Free Guarantee protects customers from fraud loss. Learn more at usbank.com/riskfree. For more information about mobile banking at U.S. Bank, please visit usbank.com/mobile or call us toll-free at 800-685-5035.

© 2019 U.S. Bank

Deposit products offered by U.S. Bank National Association

Member FDIC, Equal Housing Lender